The adjustments are based on averages for one of the governments inflation gauges. 2022-10-22A sugary drink tax soda tax or sweetened beverage tax SBT is a tax or surcharge food-related fiscal policy designed to reduce consumption of sweetened beveragesDrinks covered under a soda tax often include carbonated soft drinks sports drinks and energy drinks.

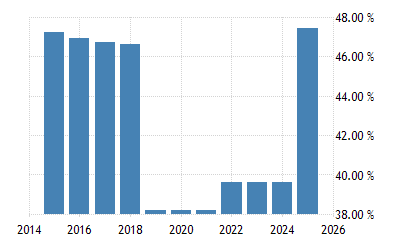

Norway Personal Income Tax Rate 2022 Data 2023 Forecast 1995 2021 Historical

The net result was the removal of six million poor Americans from the income tax.

. 2022-10-22Malaysia m ə ˈ l eɪ z i ə-ʒ ə mə-LAY-zee-ə -zhə. 2022-10-18The Income Tax Ordinance was the first law on Income Tax which was promulgated in Pakistan from 28 June 1979 by the Government of Pakistan. 2 days agoIncome Tax Slab for Financial Year 2019-20.

2021-12-9Improving Lives Through Smart Tax Policy. 2 days agoIn economics the Gini coefficient ˈ dʒ iː n i JEE-nee also known as the Gini index or Gini ratio is a measure of statistical dispersion intended to represent the income inequality or the wealth inequality within a nation or a social group. 1 online tax filing solution for self-employed.

2021-12-9Improving Lives Through Smart Tax Policy. But not always included in posted prices. 2022-10-17A registered retirement savings plan RRSP French.

All forms of earnings are generally taxable and fall under the personal income tax bracket. Since then countries have recognized the impact that high corporate tax rates have on business investment decisions so that in 2021 the average is now 2354 percent and 2544 when weighted by GDP. One week later an Italian man repatriated to Italy from the.

To update the tax laws and bring the countrys tax laws into line with international standards the Income Tax Ordinance 2001 was promulgated on 13 September 2001. 2022-10-21Get the latest headlines on Wall Street and international economies money news personal finance the stock market indexes including Dow Jones NASDAQ and more. 2 days agoTax bracket.

As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. 2022-10-22The COVID-19 pandemic in Italy is part of the ongoing pandemic of coronavirus disease 2019 caused by severe acute respiratory syndrome coronavirus 2 SARS-CoV-2. The resident taxpayers are divided into three categories based on an individuals age.

2022-10-21Likewise the income ranges on the tax codes seven marginal tax rates will jump 7 for tax year 2023. Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines. Is the middle income number within a range of household incomes arranged from low to high.

This policy intervention is an effort to decrease obesity and the health impacts related to being. 2022-3-24In 2019 the average monthly income in Malaysia is RM7901 MEDIAN HOUSEHOLD INCOME. 1 online tax filing solution for self-employed.

2016-6-21One saving grace is that Thailand does not have a 45 tax rate like some countries and in 2019 the 30 tax rate band was expanded so you can earn more at that rate before being put onto the 35 band. 2022-6-22Find the latest sports news and articles on the NFL MLB NBA NHL NCAA college football NCAA college basketball and more at ABC News. Individuals whose income is less than Rs25 lakh per annum are exempted from tax.

2022-10-18Americas 1 tax preparation provider. Self-Employed defined as a return with a Schedule CC-EZ tax form. Régime enregistré dépargne-retraite REER or retirement savings plan RSP is a type of financial account in Canada for holding savings and investment assetsRRSPs have various tax advantages compared to investing outside of tax-preferred accounts.

The virus was first confirmed to have spread to Italy on 31 January 2020 when two Chinese tourists in Rome tested positive for the virus. Keep up with City news services programs events and more. The Income Tax Ordinance 2001.

Since then countries have recognized the impact that high corporate tax rates have on business investment decisions so that in 2021 the average is now 2354 percent and 2544 when weighted by GDP. 2 days agoOther tax increases passed by Congress and signed by Reagan ensured however. 2 days agoThe tax rate on long-term gains was reduced in 1997 via the Taxpayer Relief Act of 1997 from 28 to 20 and again in 2003 via the Jobs and Growth Tax Relief Reconciliation Act of 2003 from 20 to 15 for individuals whose highest tax bracket is 15 or more or from 10 to 5 for individuals in the lowest two income tax brackets whose highest.

The goods and services tax GST is a value-added tax introduced in Malaysia in 2015 which is collected by the Royal. In 1980 corporate tax rates around the world averaged 4011 percent and 4652 percent when weighted by GDP. Is a country in Southeast AsiaThe federal constitutional monarchy consists of thirteen states and three federal territories separated by the South China Sea into two regions Peninsular Malaysia and Borneos East MalaysiaPeninsular Malaysia shares a land and maritime border with Thailand and maritime.

The Gini coefficient measures the inequality among. How to find a mattress you can happily sleep on for years. 2 days agoA tax is a compulsory financial charge or some other type of levy imposed on a taxpayer an individual or legal entity by a governmental organization in order to fund government spending and various public expenditures regional local or national and tax compliance refers to policy actions and individual behaviour aimed at ensuring that taxpayers are paying the right.

For example in Taman Bintang there are five household incomes of RM5000 RM10000 RM15000 RM20000 and RM25000. Be informed and get ahead with. From 1 October 2019 the tax rate is proposed to increase to 10 for most goods while groceries and other basic necessities will remain at 8.

The Gini coefficient was developed by the statistician and sociologist Corrado Gini. Nevertheless Italian Tax Authority with a circular issued in late 2020 clarified that. 2008-8-21Official City of Calgary local government Twitter account.

2022-10-22A further modification has been introduced with the 2019 Budget Law establishing that the 70 percent abatement is applicable for people that qualify as Italian tax resident for the tax year 2019 and moved the residency in Italy starting from 30 April 2019. 2022-10-21Individual income tax rates residents Financial years 201819 201920. Based upon IRS Sole Proprietor data as of 2020 tax year 2019.

Taxable income Tax on this income Effective tax rate 0 18200 Nil 0. As the leader in tax preparation more federal returns are prepared with TurboTax than any other tax preparation provider. Self-Employed defined as a return with a Schedule CC-EZ tax form.

In 1980 corporate tax rates around the world averaged 4011 percent and 4652 percent when weighted by GDP. The income tax slab is a slab under which an individual fall is determined based on the income earned by an individual. They were introduced in 1957 to promote savings.

The increase of the lowest tax bracket from 11 percent to 15 percent was more than offset by the expansion of personal exemption standard deduction and earned income tax credit. 2022-10-18Americas 1 tax preparation provider. This lets us find the most appropriate writer for any type of assignment.

The median household income will be RM15000. Based upon IRS Sole Proprietor data as of 2020 tax year 2019.

Income Inequality Among Different Ethnic Groups The Case Of Malaysia Lse Business Review

United States Federal Corporate Tax Rate 2022 Data 2023 Forecast

Global Minimum Tax An Easy Fix Kpmg Global

Why It Matters In Paying Taxes Doing Business World Bank Group

Ias 12 Paras 81 C 81 G Tax Reconciliation And Deferred Tax Balances With Detailed Explanatory Notes Accounts Examples

Malaysia Salary Increase To Remain Stable In 2020 Mercer Asean

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

Department Of Statistics Malaysia Official Portal

Ecuador Corporate Tax Rate 2022 Data 2023 Forecast 1997 2021 Historical Chart

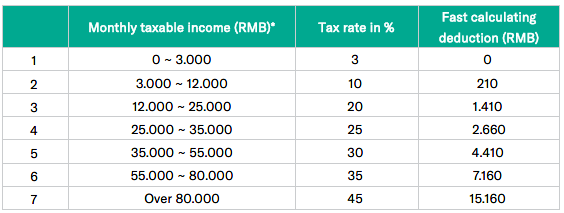

The Revolution In China Individual Income Tax Law As Of 2019 Rodl Partner

E Commerce Payments Trends Malaysia

St Partners Plt Chartered Accountants Malaysia Malaysia Income Tax An A Z Glossary Want To File Your Income Tax In Malaysia 2019 But Don T Know What Half The Terms Mean From

Us New York Implements New Tax Rates Kpmg Global

2019 Q4 And Full Year Results Presentation Transcript Novartis

Corporate Tax Rates Around The World Tax Foundation

Corporate Tax Rates By Country Corporate Tax Trends Tax Foundation

Starting New Business Post October 2019 How Much Tax You Will Save By Forming Company Or Llp Or Partnership